Signal Modes

The Lux Algo Premium Indicator displays buy/sell signals that aim to support the analysis of the trader. There are two main signal methodologies available, each one fitting a different trading style, confirmation signals, and contrarian signals. The following subsections describe these two methodologies in detail.

info

Focusing on using other features within our toolkit alongside the provided signals will likely be the best decision for you rather than using them alone.

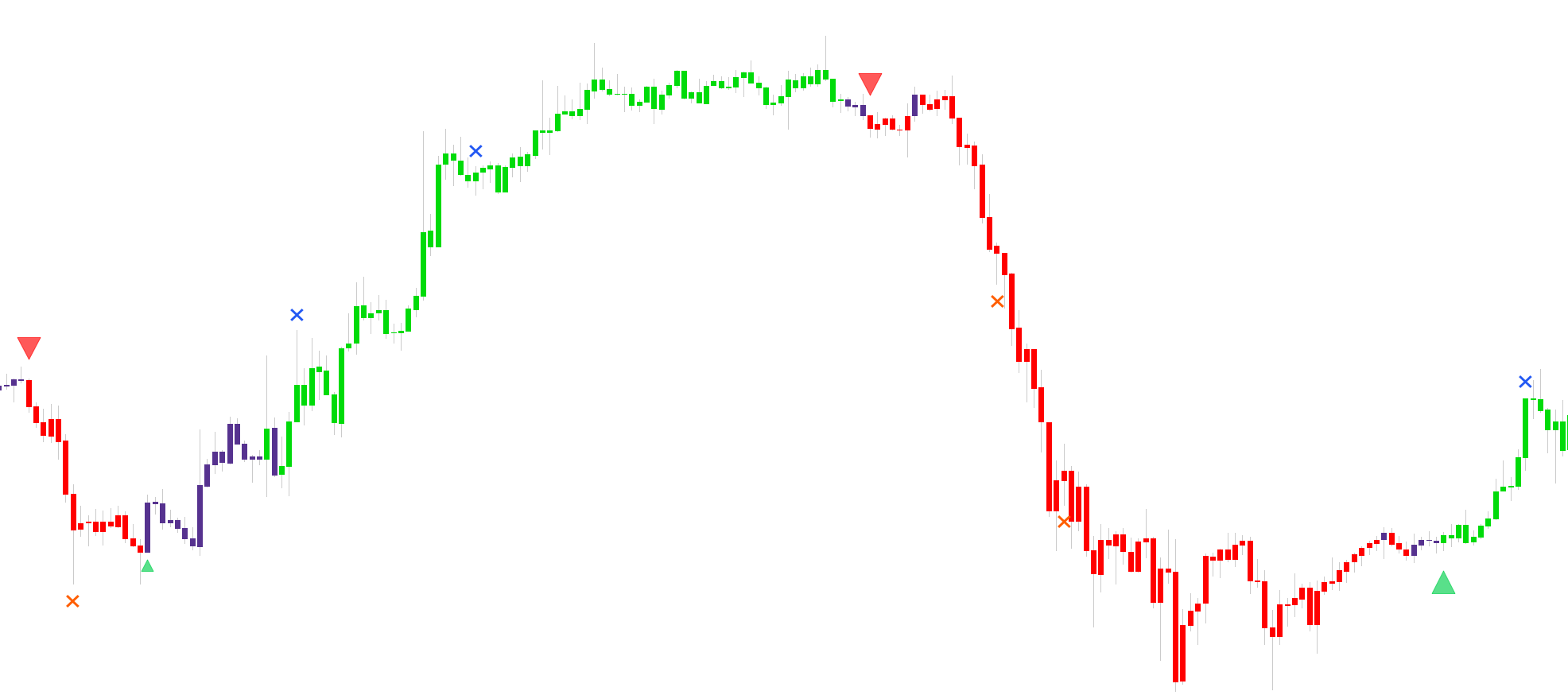

Confirmation + Exits

Confirmation signals are signals based on a trend following methodology. As the name suggests, they aim to confirm any potential action a trader might take and are more effective when used in confluence with other indicators.

There exist two types of Confirmation signals, normal signals, and strong signals. Strong signals are signals that are in accordance with the current estimated trend, while normal signals can be caused by a retracement.

The Confirmation signal mode includes exit signals (represented by colored crosses). An exit buy signal is displayed as a blue cross, while an exit sell is displayed as an orange cross.

These exits signals aim to exit a position based on a previous confirmation signal at the highest price possible. Also, note that such exits would always exit a previous confirmation signal on a win.

info

Successive exit signals can occur during longer-term trends, as such the user can do partial exits instead of exiting an entire position.

Confirmation Minimal

The Confirmation Minimal signal mode provides the same signals as the Confirmation + Exits signal mode but use a minimalistic display to avoid chart clutter. Normal Confirmation signals are represented by small triangles while strong Confirmation signals are represented by bigger triangles.

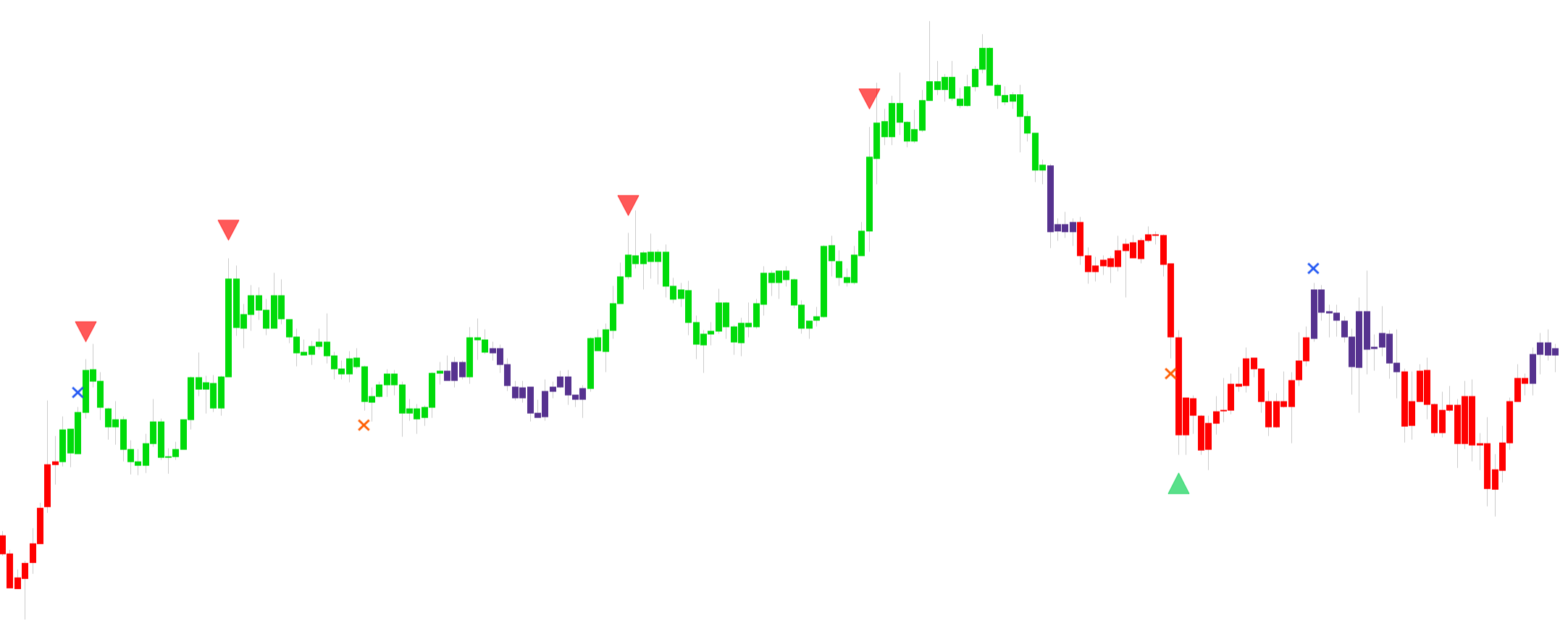

Contrarian + Exits

Contrarian signals go in opposition to the current market sentiment, aiming to deliver extremely fast decision timing, more simply put, contrarian signals aim to spot potential tops and bottoms.

The advantage of contrarian methodologies is that they are less subject to lag than most trend-following methodologies, thus allowing for potentially higher profits. However, it must be noted that going against the trend exposes the trader to larger price variations, which means potentially higher losses.

Like the confirmation signals, contrarian signals can also be strong, these occur when the price is excessively overbought or oversold, and have more chances of indicating a potential retracement.

info

Extra confirmation such as declining volume or the occurrence of the signal near a significant support/resistance can be useful to tell when a signal is indicative of a reversal.

You can also use the contrarian signals more safely by exiting a position rather than opening them when a signal occurs.

The Contrarian signal mode also includes exit signals. An exit buy signal is displayed as a blue cross, while an exit sell is displayed as an orange cross.

Like with Confirmation signals, Contrarian exits would always exit a previous confirmation signal on a win. However note that successive exits will not occur for Contrarian signals.

tip

Contrarian Exits can be helpful when price temporarily move in accordance with a displayed Contrarian signal before reversing, rendering the signal false.

If the user are confident that price might still evolve in accordance with a previously displayed Contrarian signal, the exit can be ignored or could lead to a partial exit only.

Contrarian Minimal

The Contrarian Minimal signal mode provides the same signals as the Contrarian + Exits signal mode but use a minimalistic display to avoid chart clutter. Normal Contrarian signals are represented by small triangles while strong Contrarian signals are represented by bigger triangles.

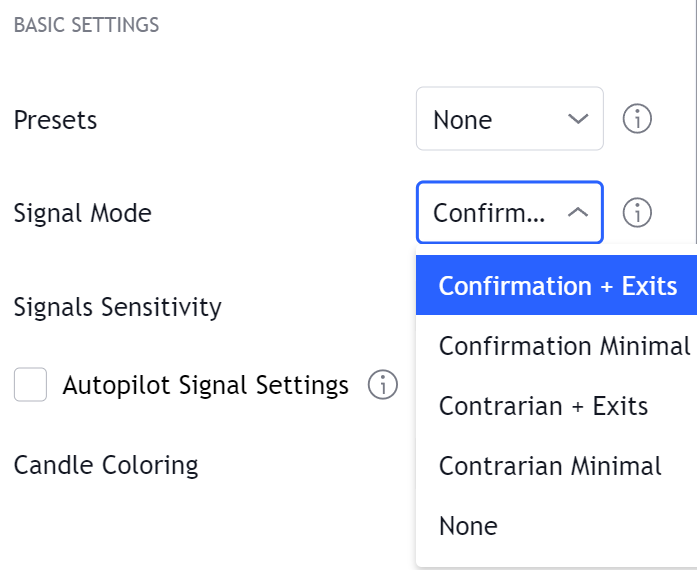

Display

It is possible to choose what type of signals you want to display as well as displaying no signals at all, this is done from the settings panel in the signal mode drop-down menu.

By default Confirmation + Exits is selected. None will not display any signal on the chart.

caution

Signals are confirmed at the opening of the next candle, if you see a signal displayed on the most recent candle remember that it might be subject to change.