Diversification

The question of which assets and securities to trade are extremely important, and such decision should be taken in relation to your risk aversion. It can be common for newcomers to focus on only one market and security, however, diversifying your portfolio is a good way to minimize risk instead of being exposed to the variation of only one security.

Asset Allocation

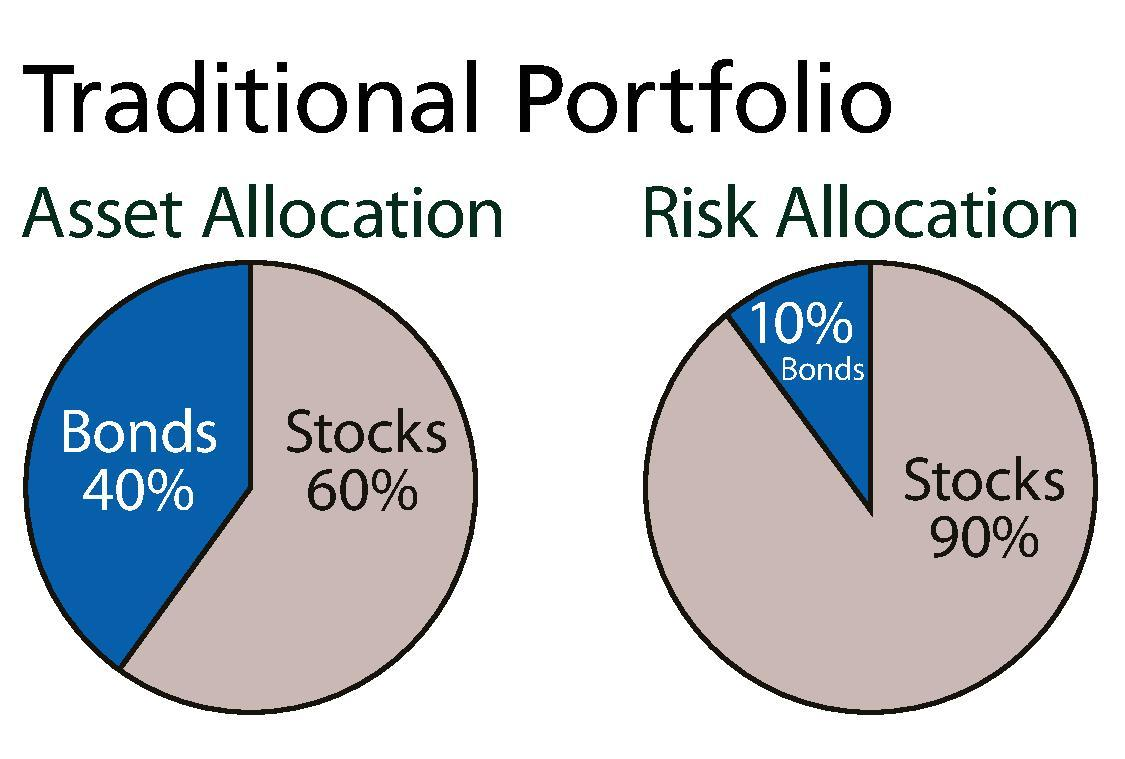

Having a portfolio containing various assets can allow an investor to balance risk. With assets allocation, you can mix various asset classes such as stocks, commodities, bonds...etc.

Adding less risked assets to your portfolio can decrease potential returns but will minimize risk, for example, a portfolio consisting of 100% stocks will be more risked than one consisting of 60% stocks and 40% bonds but will have potentially higher returns.

Optimal asset allocation can depend on the trader profile, more aggressive traders might want to have a low percentage of low-risk assets, even 0%, conservative traders on the other hand will prioritize safer assets. Some commons assets allocations consist of more than 50% of assets for speculation, and less than 50% of assets generating a fixed income.

Security Selection

Some traders will only focus on speculative assets or even on only one market, but this does not mean that diversification can't be achieved, a trader might only trade in the stock market yet have a portfolio consisting of various stocks.

Choosing the right securities is primordial, as a general rule, always choose liquid securities since they will generate lower transactions cost and faster order execution speed.

In terms of diversification, it is more effective to reduce the risk by choosing securities with a low correlation. The correlation between two securities can be quantified with a value between 1 and -1, with 1 showing a perfect positive correlation (the securities prices tend to go in the same direction), while a correlation of -1 shows a perfect negative correlation (the securities prices tend to go in opposites directions), while a correlation 0 shows no correlation between the securities.

Modern Portfolio Theory

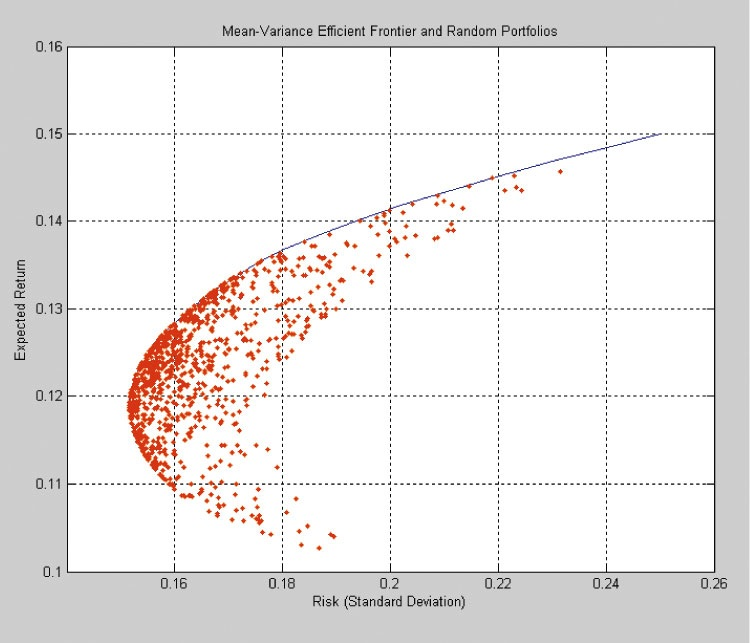

The modern portfolio theory (MPT) defines how an investor can select optimal portfolios given a certain risk level.

Selection of an optimal portfolio can be done by plotting the portfolio expected return against the portfolio risk, the portfolio that has the highest return given a certain risk level is considered optimal, each one of these optimal portfolios given a risk level form what is called the efficient frontier.