Indicator Overlay

The Lux Algo Premium Indicator allows the user to display various technical indicators directly to their chart, these can be used in confluence with the confirmation/contrarian signals are as standalone. Each of these indicators is covered below.

info

Other settings do not affect these indicators.

Neo Cloud

When enabled, a simple cloud like indicator will be displayed on your chart. The Neo Cloud is similar in effect to the Ichimoku Cloud, and can determine the current trend direction.

The cloud is filled with a gradient color showing how new a detected trend is, with brighter colors indicating older trends.

This cloud can provide a support when an uptrend is detected or resistance when a downtrend is detected. This makes it pertinent for pertinent entries into precise trades.

Reversal Zones

When enabled, one upper and one lower zone will be displayed on your chart, each zone is designed to help the user find tops and bottoms whether the market is ranging or trending (however the indicator will still be more effective during ranging markets).

These zones can be great areas to take profit or find early entries to use alongside the confirmation or contrarian signals.

info

During periods of increased volatility, the price may move outside the zones, you can wait for the price to go back within each zone to take a decision.

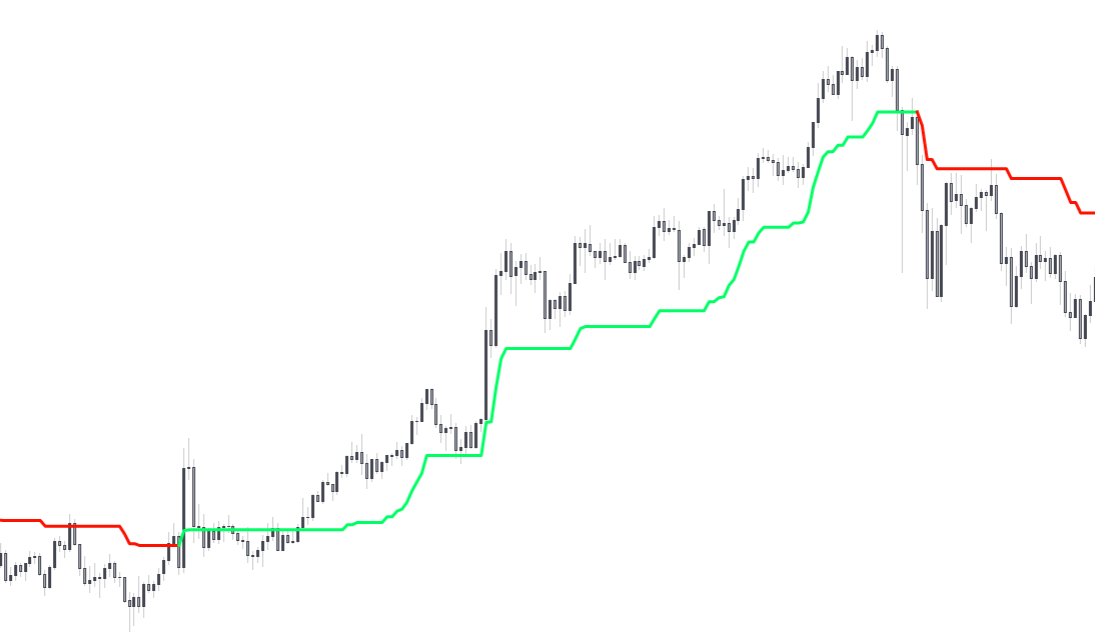

Trend Tracer

The trend tracer is a trend-following indicator that aims to estimate the underlying trend in the price. When the indicator indicates an uptrend its color will be green, while red in the case of a downtrend.

info

The trend tracer can be used as a trailing support/resistance tool, you can also use it in confluence with the confirmation signals, either by waiting for the price to reach the trend tracer in order to enter a trade corresponding to the current confirmation signal or by filtering shorter-term signals by only trading those in accordance by the trend estimated by the trend tracer.

Trend Catcher

The Trend Catcher is a similar indicator to the previous Trend Tracer, however, it aims to detect very early trends, and is thus more reactive.

Like with the Trend Tracer, the color of the indicator determines the detected trend.

HyperTrend

The HyperTrend indicator estimates linear underlying trends in the price in real time, and can determine whether the price is uptrending or downtrending. An additional support and resistance area is displayed.

A line slopping upwards would indicate that the HyperTrend is detecting an uptrend, while a line slopping downwards would indicate a downtrend.

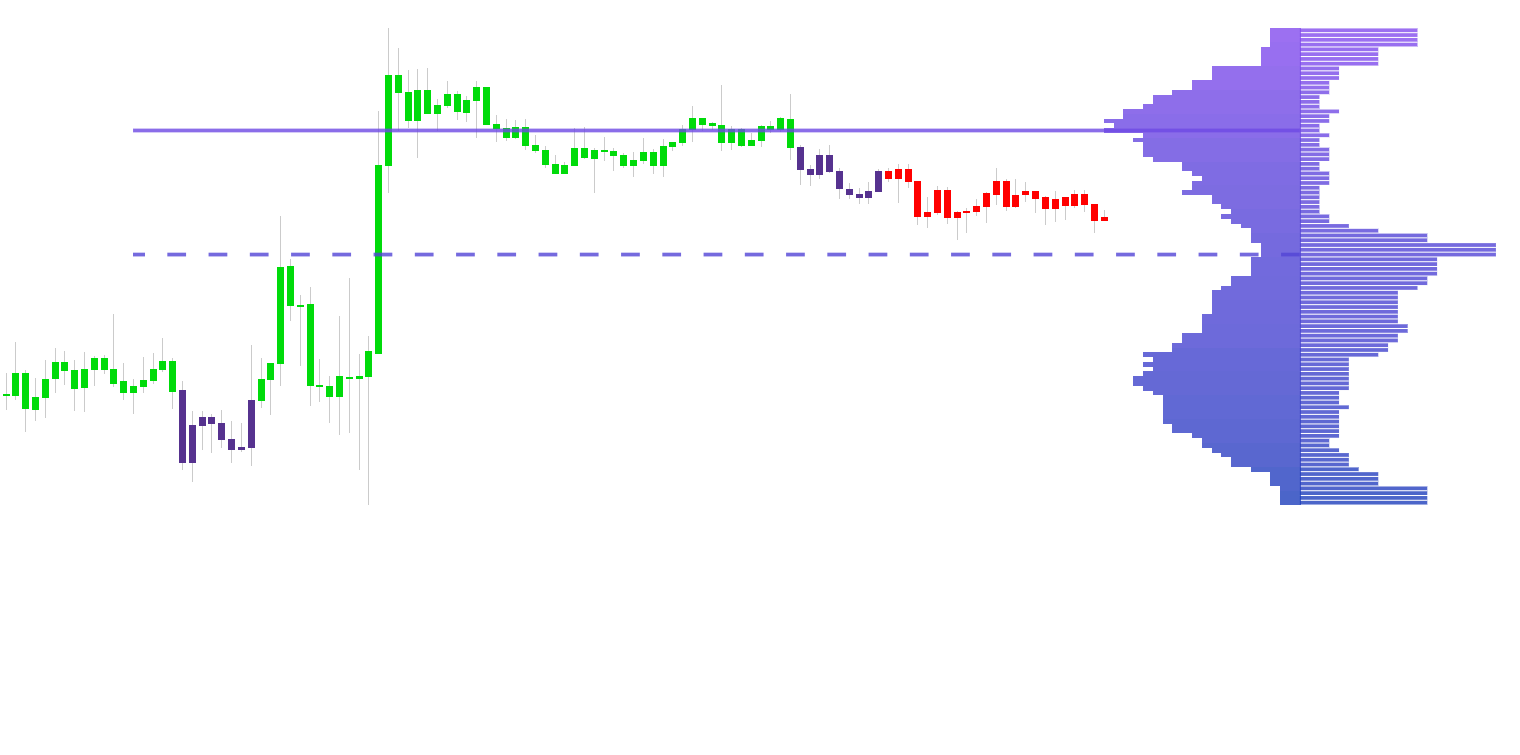

Lux Profile

The Lux Profile is an indicator inspired by the classic volume profile, and is calculated from the most recent 100 bars using 100 price intervals.

This profile is made of two components, a weighted volume profile on the left showing the accumulated weighted volume within price intervals. A point of control (POC) solid line indicating the price level with the most accumulated weighted volume. This POC can be used as a potential support/resistance level.

The component on the right indicates the degree of variations of the prices within their respective intervals. A dashed line highlights the price level with the highest degree of variation.

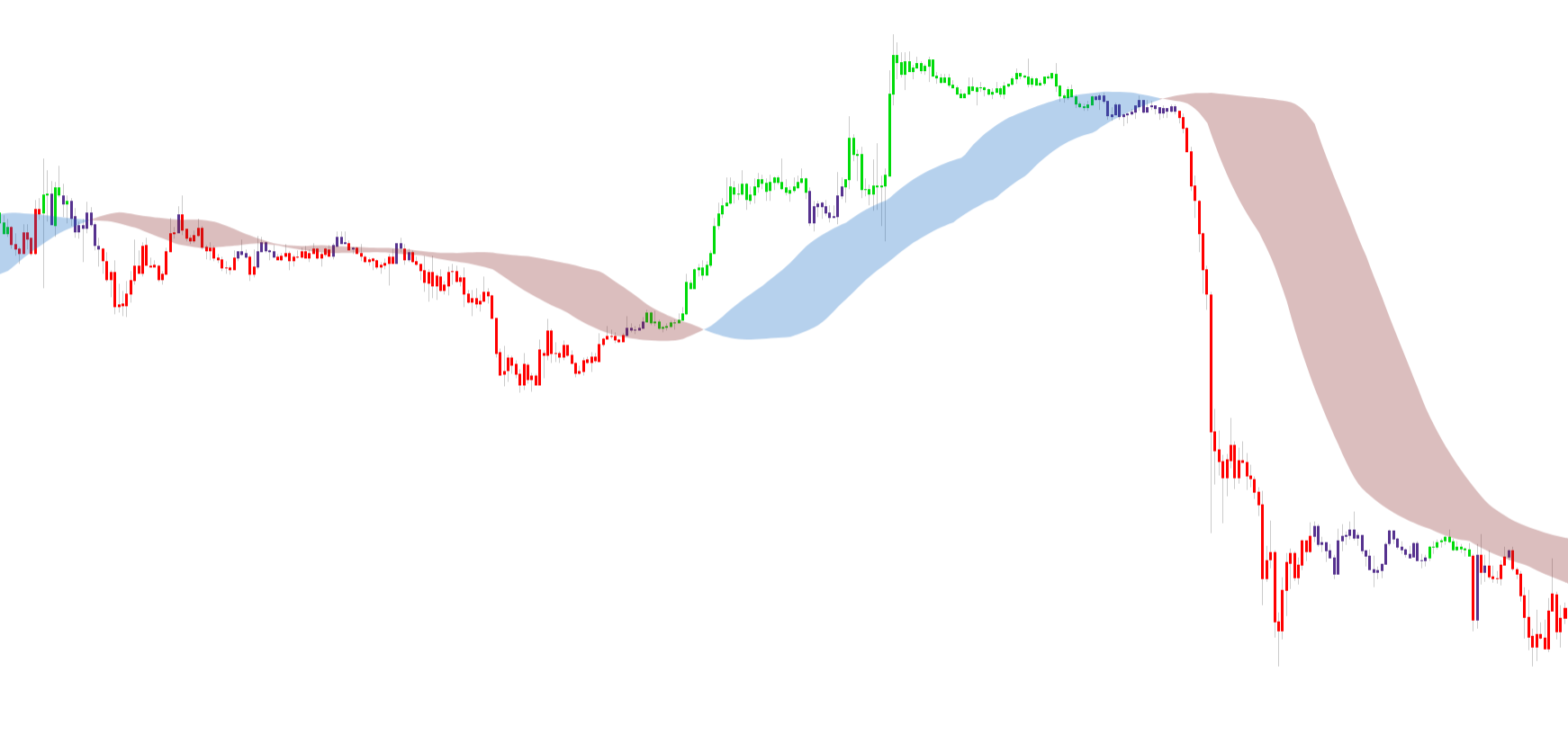

EQ Cloud

When enabled, a simple "cloud" like indicator will be displayed on your chart. The EQ Cloud is similar in effect to an Ichimoku Cloud, and can determine the current trend as well as providing trailing support and resistance.

The cloud color highlight the current detected trend by the cloud, with a blue color indicating an uptrend and a red color indicating a down-trend.