Money Management

Now that you have a precise trader profile, an initial capital, a portfolio and entry rules, you will be able to start trading, if you don't have a broker yet you can find a list of the brokers we recommend here:

»Recommended BrokersThe next step is to develop a good money management strategy, this is crucial toward trading more profitably. When you start trading, you can't simply start buying and selling securities using random position sizing or without having a precise risk/reward in mind, money management will help you have control over the risk you are willing to take and will improve your capital lifetime.

Position Sizing

The size of your position determines the number of contracts of a security you will purchase. There are various ways to size your positions, the best way being by taking into account your risk aversion. If you don't want to lose x percent of your capital you will then need to size your position accordingly.

You can determine the size of an investment based on the percentage of capital you are willing to risk, or base the size depending on if the market is volatile or not, using lower position when market is volatile to reduce risk.

warning

Don't use aggressive position sizing strategies such as martingales, which might make you lose all your initially invested capital in a short amount of time.

Position Sizing With The Kelly Formula

The Kelly formula is used to determine the percentage of capital you can use for your position size based on past performances and is calculated as follows:

Where is the percentage of capital you can invest in a position, the probability of a win, and the ratio of win/losses. In order to get the probability of a win take a look at your past trades, and divide the number of winning trades by the total number of trades, this will give you. To calculate , divide the average gains by the average losses.

Note that this value can be negative, which implies that the average gains are lower than the average losses.

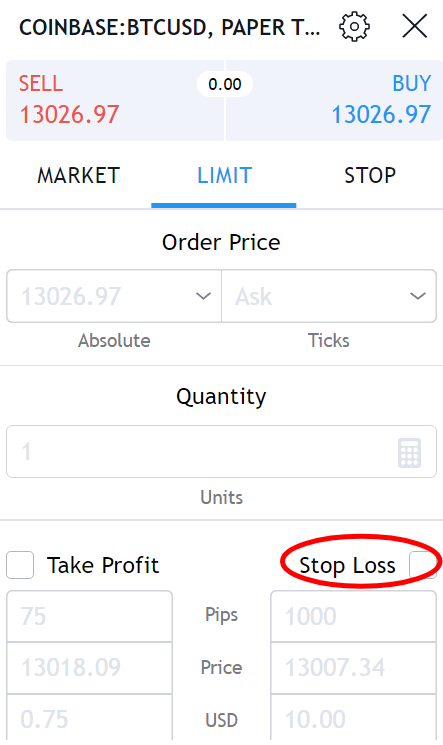

Stop Loss

Stop losses help you protect yourself against variations opposite from the one you had anticipated, trading without a stop loss exposes yourself to potentially volatile variations that will significantly affect your capital.

In general stop losses are set at a specific price level, once the price reaches this level, your current position will be closed. Some platforms also allow you to set the distance between the price and your stop loss based on a value in pips, dollars, or percentage.

caution

A stop loss will be filled once it triggers, but this does not necessarily mean it will be filled at the price it was set! As such you might have additional losses you were not expecting.

Where To Place A Stop Loss?

Your initial capital and your risk aversion are the most important factors when it comes to placing a stop loss. If you can't afford a $10 loss, then place your stop loss in accordance, but there are also more factors to take into consideration.

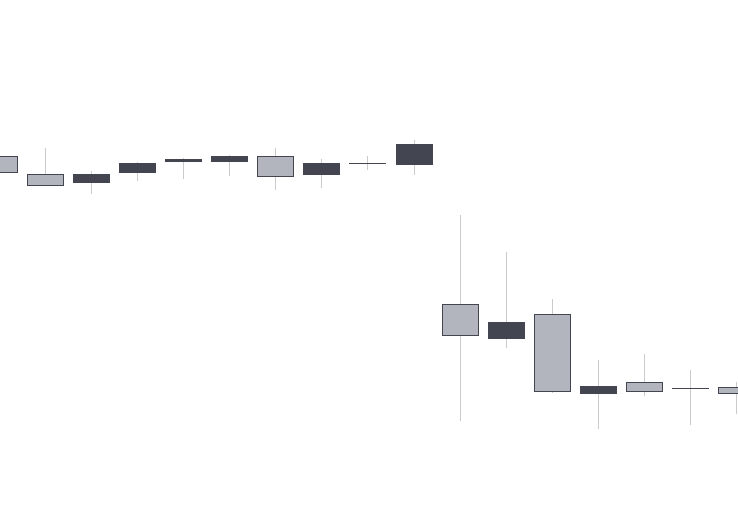

Volatility is an important factor, when a trader is expecting volatile moves, placing a stop-loss too close to the price might trigger it too fast, thus generating an unnecessary loss. Place your stop loss in consideration with the price variation volatility. If you are willing to trade a more volatile move, you are willing to take more risk, as such give some headroom to your stop loss.

The trade horizon and profit target is also an important factor, long-term trades with a more significant profit target will require a more distant stop-loss.

Trailing Stop Loss

While a stop loss will protect you from loss, a trailing stop loss will also be able to protect your current profits. As its name suggests, a trailing stop loss is a stop loss whose level changes over time, and is often set a percentage away from the current price.

Gaps

A gap is a structure in price where the opening price is different from the previous closing price. Since gaps are often produced by the market reopening, they are frequent in the stock market and can occur in the forex market, while they are virtually non existent in the crypto market.

Gaps are extremely important to take into account as they might trigger a stop loss at a significantly different price, and as such, present additional risk! There are various solutions toward avoiding this problem, one being closing any positions before the market closes.

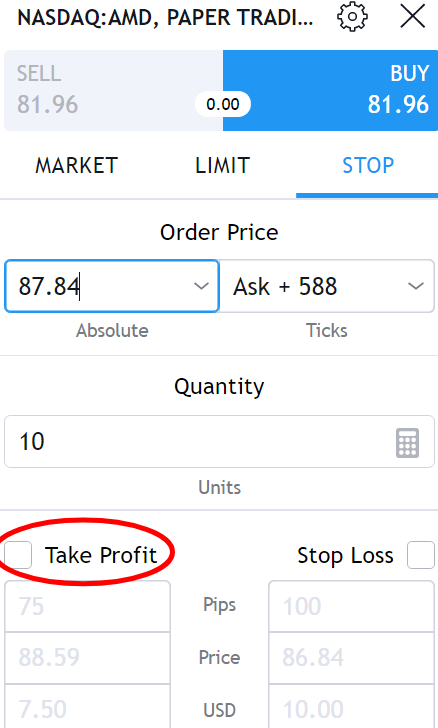

Take Profits

Like a stop loss, take profits allows a trader to close a position once a certain price level is reached, however as their name indicates, take profits execute for a profit, and not for a loss.