Ultimate MACD

The Ultimate Moving Average Convergence Divergence (UMACD) oscillator is similar in practice to the classic MACD oscillator, but aims to preserve more accuracy using both the cycle and trend components in the price adaptively while removing noisy variations. This can give a predictive edge to the UMACD allowing for earlier entries and less lag compared to a regular MACD.

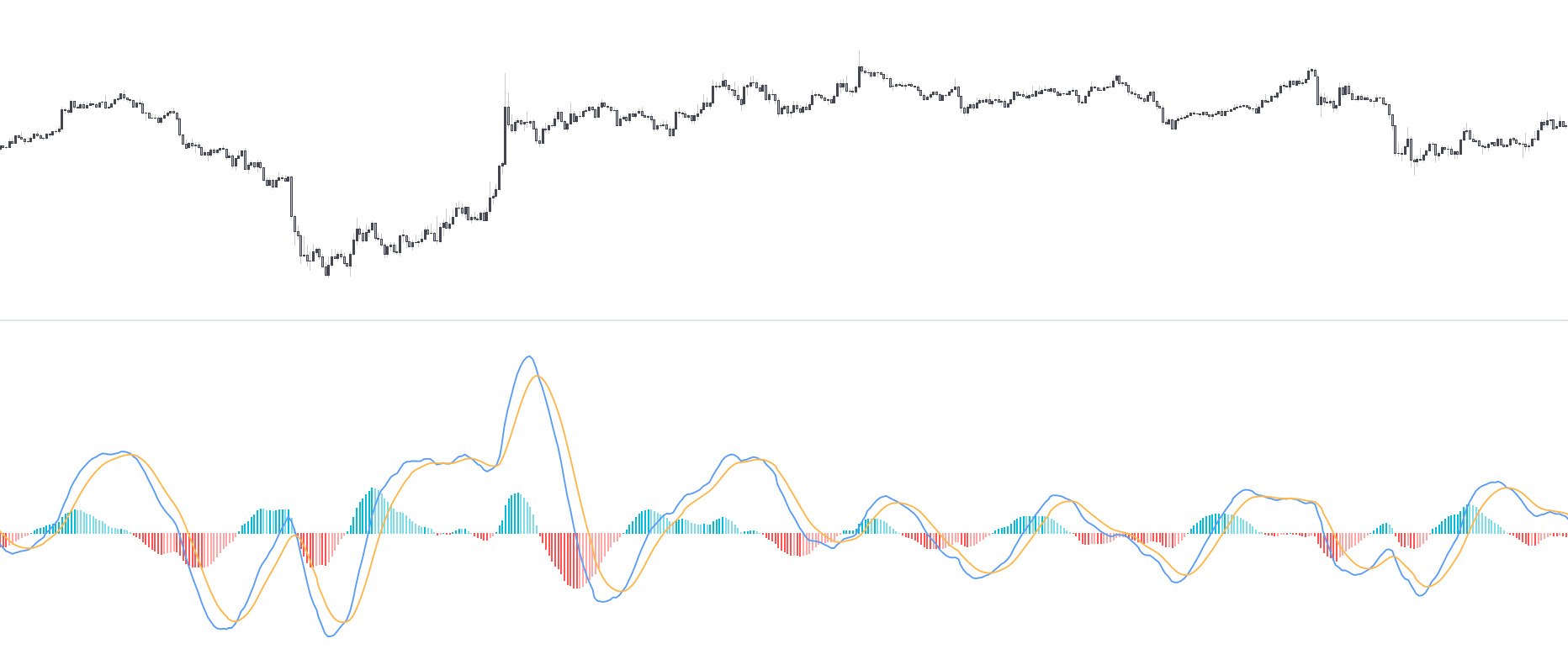

More cyclical variations will be returned during ranging markets while longer term variations will be returned during trending markets.

Usage

The Ultimate MACD contains each element present in the regular MACD oscillator: the MACD oscillator line, its signal line, and an histogram representing the difference between the MACD and its signal line.

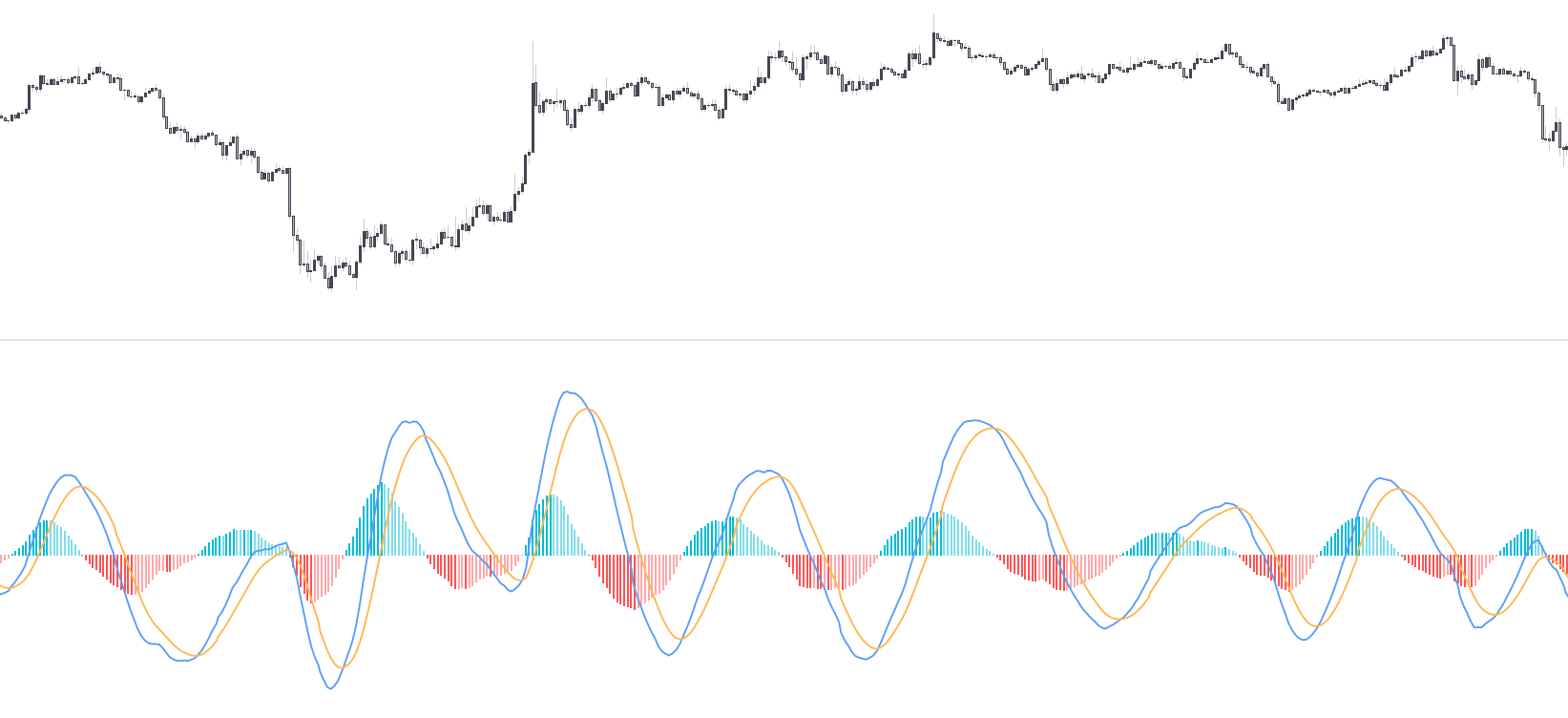

Using higher Fast and Slow settings will aim to preserve longer term variations of the cycle and trend components in the price.

Using a Fast period closer to the Slow period will return more cyclical variations in the MACD.

A MACD value over 0 or its signal line (histogram above 0) indicate an uptrending market, while values under 0 would be indicating a down-trending market.

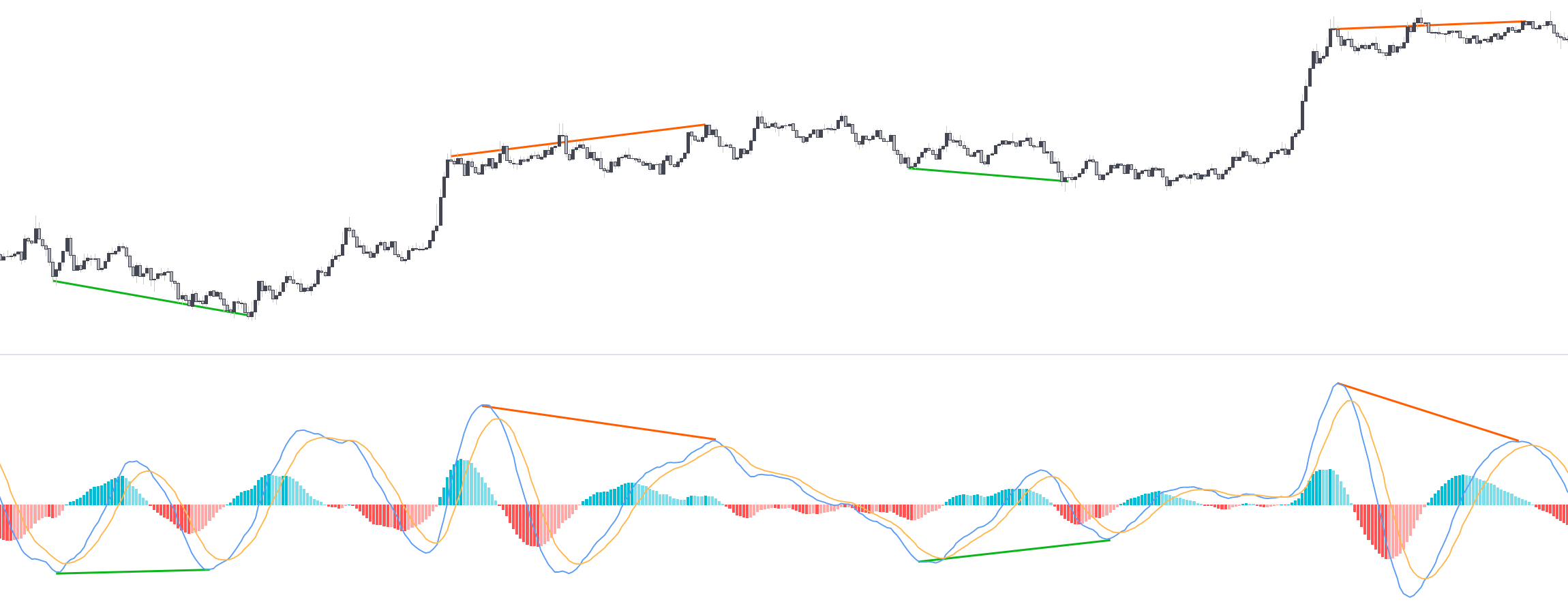

Like the classic MACD oscillator divergences with the price can be returned indicating potential reversals, these can arise from the cycle or component, which could lead to medium term reversals or from the trend component, which might lead to longer term reversals.