Advanced

The Advanced Oscillator type aims to return various actionable information to the trader, including adaptive trend/cycle estimation, automatic and real-time divergences detection, as well as an estimate of institutional activity.

Each element of this oscillator is on a scale going from 0 to 100, and is described in the sections below.

Main Oscillator

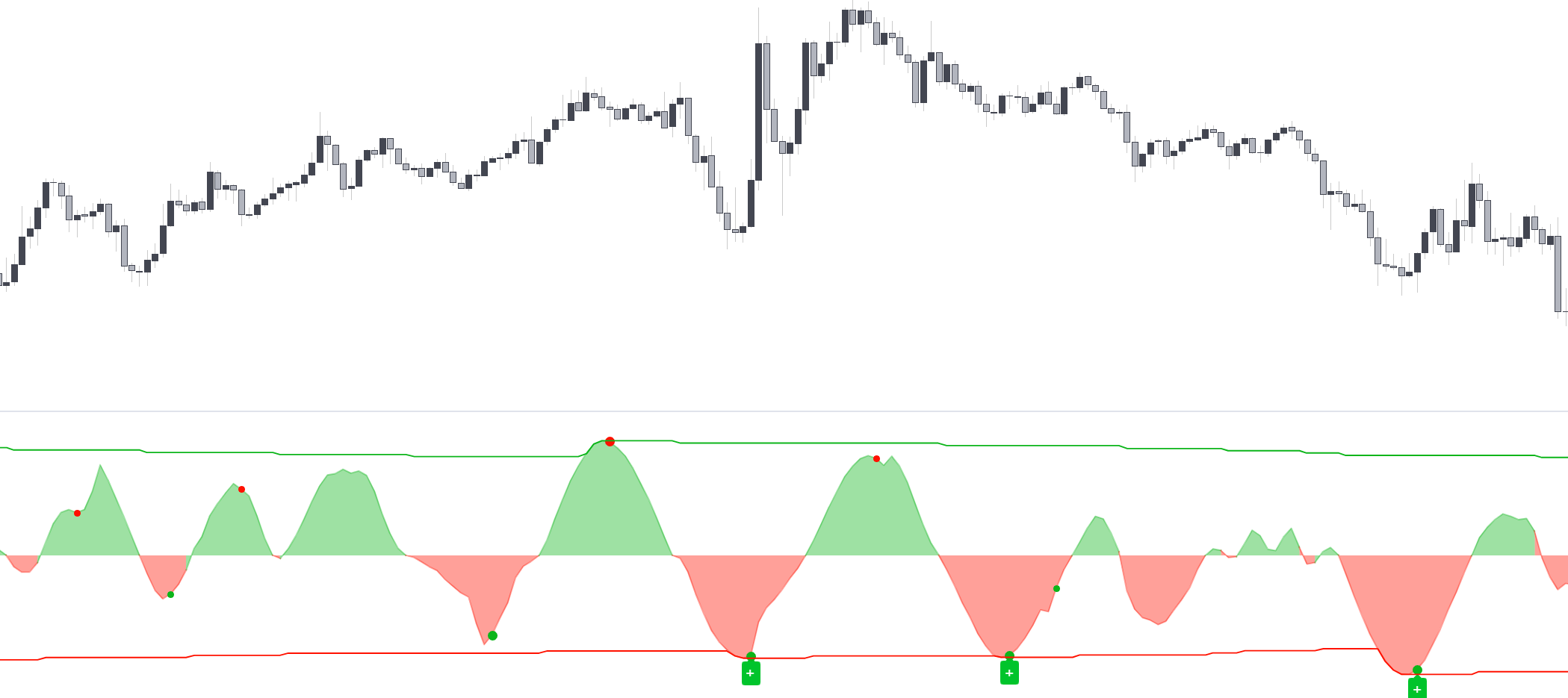

The Main Oscillator is a simple trend following oscillator which can help you understand the underlying trend in the price as well as the momentum. This oscillator plays an important role within the Advanced mode.

Cycle Oscillator

The Cycle Oscillator has a cyclical and leading nature, and as such might anticipate certain price movements before they occur. Signals and automatic divergence detection are based on this oscillator.

Institutional Movement

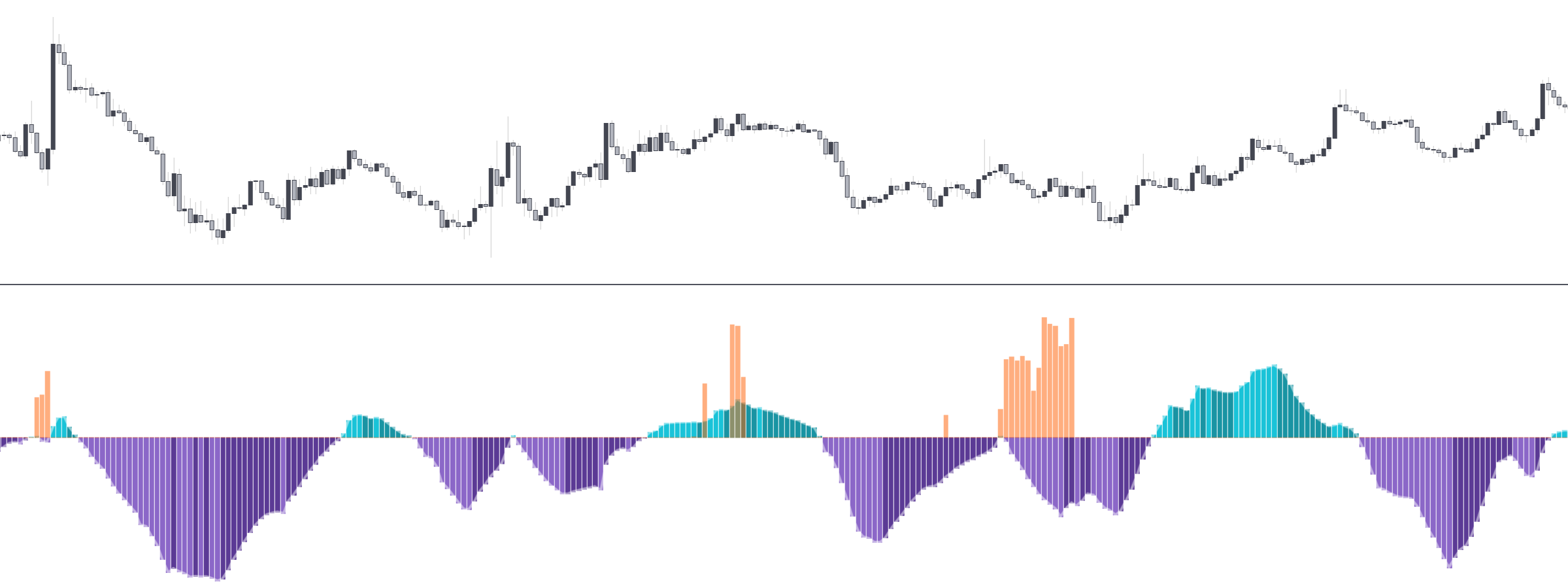

The Advanced Oscillator type also displays an estimate of the institutional activity in the market, this estimate is based on Shalen’s hypothesis. Using a higher value for the Length setting aims to detect more significant institutional activity. Institutional activity can preceed important price variations.

Institutional activity is detected when the orange histogram is visible.

info

Note that higher time frames can return fewer occurrences of detected institutional activity.

caution

Make sure the symbol you are applying the Lux oscillator while using the Lux type contains volume data, or else the institutional movement will not be visible.

Signals

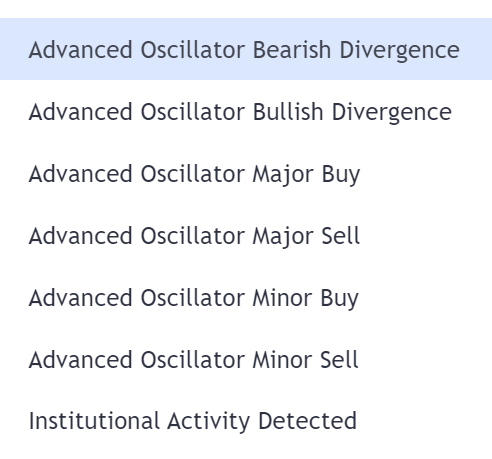

The Advanced Oscillator type contains signals highlighted by labels. These signals are respectively denoted as "Major Buy", "Major Sell", "Minor Buy", and "Minor Sell". Note that these signals are not of a trend following nature but contrarian and as such aim to detect potential reversals.

Major signals aims to detect more significant reversals and generally occur when price is significantly overbought/oversold. Minor signals in the other hand will generally tend to detect less significant price reversals.

info

Note that Major Sells are disabled by default. You can enable Major sell signals from the style settings.

Bullish/Bearish Divergences

Divergences are detected in real-time, and aim to show potential reversals with the price. These are displayed as lines with small dots at the extremity, with green lines representing bullish divergences and red lines representing bearish divergences. Thse are based on the cycle oscillator.

info

It can be a good idea to have extra confirmation when a divergence has been detected, having a divergence plus a prior major/minor buy/sell can give some additional confidence.

caution

Due to its real-time nature, the detection of divergences can be sensitive to noise, make sure to see if a detected divergence is due to a noisy variation.

Alerts

The Advanced Oscillator contains various alerts conditions related to the Advanced oscillator type. You will be alerted each time the alert triggers.

Institutional Activity Detected

The user is alerted each time institutional activity is detected in the market (that is the first time the lux institutional movement histogram becomes visible).